Implied interest rate calculator

Given a specified range of dates the IRR is the implied interest rate at which the initial capital investment must have grown to reach the ending value from the beginning value. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option.

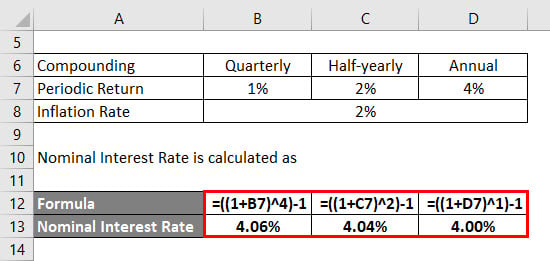

Floating Interest Rate Formula And Variable Pricing Calculator Excel Template

The higher the percentage the more you have to pay back for a loan of a given size.

. Higher Discount Rate Lower NPV and Implied Valuation Lower Discount Rate Higher NPV and Implied Valuation Therefore the expected return is set higher to compensate the investors for undertaking the risk. Express implied or statutory. Delta is on a scale from 100 to -100.

Interest rate of mortgage. Specifically the duration is the first derivative of the bonds price as it relates to interest rate changes. Assumptions optional inputs 2 - Expected Rents.

It acts as a good reference point for understanding whether the IV is higherlower as compared to the historical volatility. More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables. Modified duration is the estimate of the price change of the bond for a 1 move in interest rates.

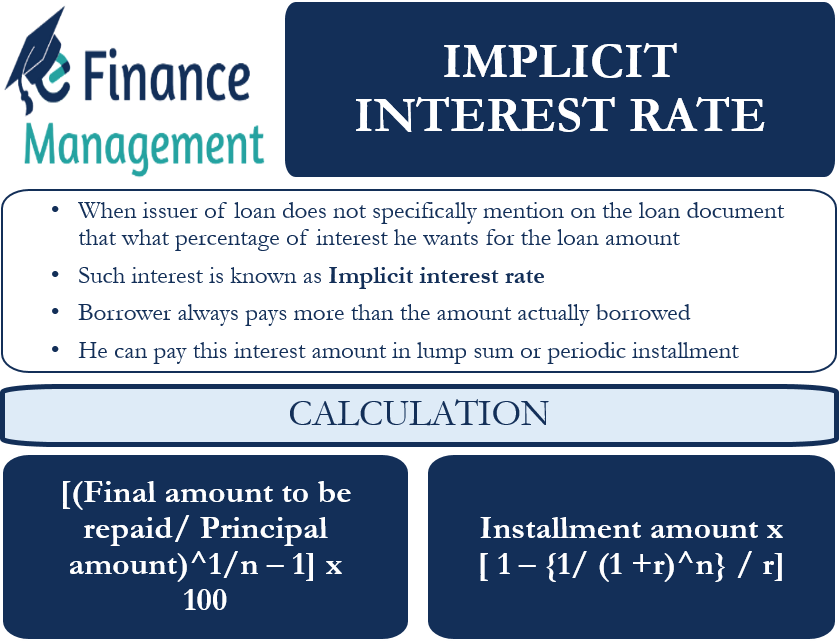

An implicit interest rate is the nominal interest rate implied by borrowing a fixed amount of money and returning a different amount of money in the future. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Just enter your parameters and hit calculate.

STGC does not make any express or implied warranties with regard to the use of the Stewart Rate Calculator and shall not be responsible for any errors or omissions or for the results obtained from the use of such information. Examples if any are based on limited and dated information and may not be relied upon for accuracy or any other purpose other than illustrative of possible results. The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry.

Interest conversion amortization Bond calculations 3 Input key markup cost price and margin Date and change of days IRR per year NPV beginningend of payment period Calendar and coupon payment schedules settlement and maturity dates bonds 4 K memory register percent cash flow amount statistics entry backspace Swap percent change. Implied Volatility vs Historical Volatility. Implied consent laws help police gather evidence of impaired driving.

So if youre a borrower the interest rate is the amount you are charged for borrowing money shown as a percentage of the total amount of the loan. Deep-in-the-money options eventually move dollar for dollar with the underlying stock. For example if you borrow 100000 from your brother and promise to pay him back all the money plus an extra 25000 in 5 years you are paying an implicit interest rate.

Delta measures the rate of change of the theoretical option value to changes in the underlying assets price. Vis-a-vis the implied volatility as explained above historical volatility is the actual computed volatility of the stocksecurityasset over the past year. Inflation and the 2 target.

Option-implied probability density functions Research datasets Statistics requested by users. If we were to calculate the IRR using a calculator the formula would take the future value 210 million and divide by the present value -85 million and raise. There may be variables that need to be considered in determining the final rate to be charged including geographic and.

The rate hikes would ensure lower borrowings which will affect the industry as liquidity is mopped up by the central bank from the market by this procedure. Black Scholes model assumes that option price can be determined by plugging spot price exercise price time to expiry volatility of the underlying and risk free interest rate into Black Scholes formula. Real Estate Investment Calculator.

You should verify all information obtained. The First American Comprehensive Calculator FACC is an Internet-based platformwhich provides our customers with a user-friendly method of obtaining estimates for certain categories of settlement related costs. Interest rates and Bank Rate.

These laws stipulate that drivers pre-agree to undergo blood alcohol content BAC. What is quantitative easing. Bond duration is also a measure of a bonds sensitivity to interest rate changes.

Interest can be earned over time if the capital is received on the current date. In Westdeutsche Landesbank Girozentrale v Islington London Borough Council 1996 AC 669 Lord Goff of Chieveley said at page 684. In financial mathematics the implied volatility IV of an option contract is that value of the volatility of the underlying instrument which when input in an option pricing model such as BlackScholes will return a theoretical value equal to the current market price of said optionA non-option financial instrument that has embedded optionality such as an interest rate cap.

However the duration is only a linear approximation. Interest Rate Dividend Yield Market Price. Note calls and puts have opposite delta signs.

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option trader to know how the changes in these variables affect the option price or option premium. One would expect to find in any developed system of law a comprehensive and reasonably simple set of principles by virtue of which the courts have. Calculating Claims of Interest February 28 2014 Introduction.

Interest rates and Bank Rate Payment and settlement. A key interest rate hike is on the anvil as per the Bank of Canada which is the 5th consecutive rate hike this yearThe hike that banks expect is 075 per cent thereby increasing the rate to 325 per cent. The Option Greeks sensitivity measures capture the extent of risk related to options trading.

Discount Rate Calculator WACC Excel. Future cash flows are discounted at the discount. Every state has an implied consent law.

Present Value - PV. Gamma is the measurement of the rate of change of the Delta. An interest rate tells you how high the cost of borrowing is or high the rewards are for saving.

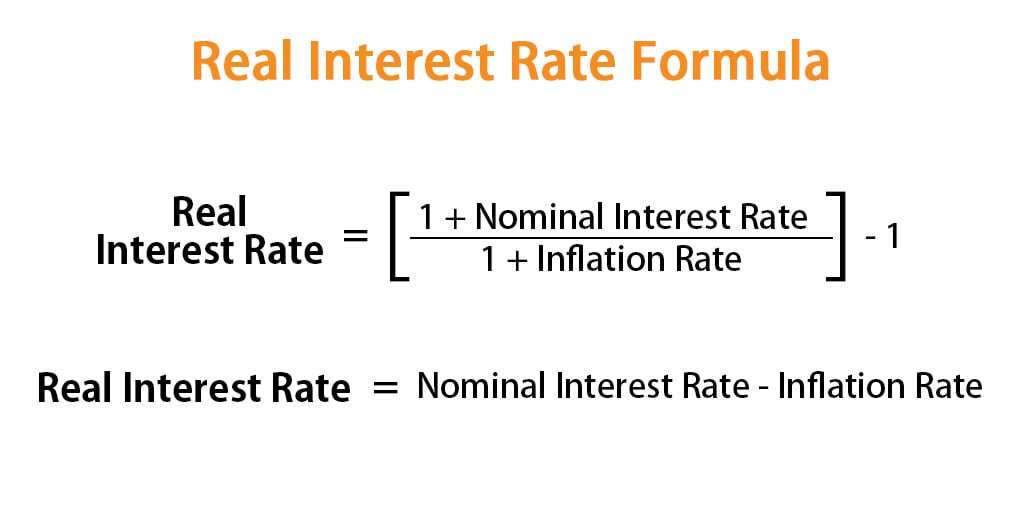

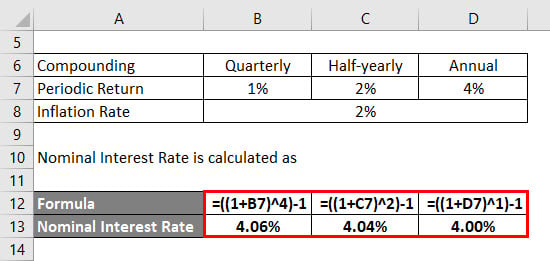

Real Interest Rate Formula Calculator Examples With Excel Template

Morgan Stanley Here Are Our Interest Rate Forecasts For 7 Taper Scenarios Scenarios Graphing Morgan Stanley

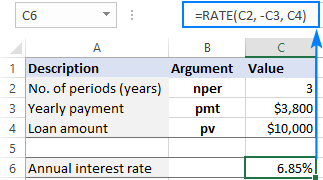

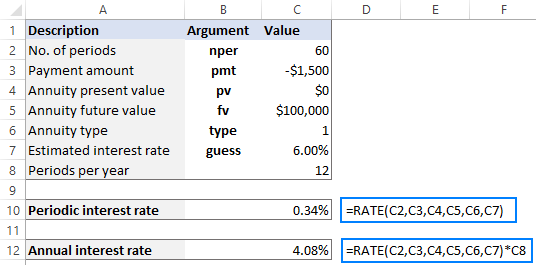

Using Rate Function In Excel To Calculate Interest Rate

Buying A Used Car Becomes Slightly Less Daunting Next Year Car Buying Car Buying Guide Cars For Sale Used

Risk Management And Risk Reward Ratio Rules Risk Reward Risk Management Technical Analysis Charts

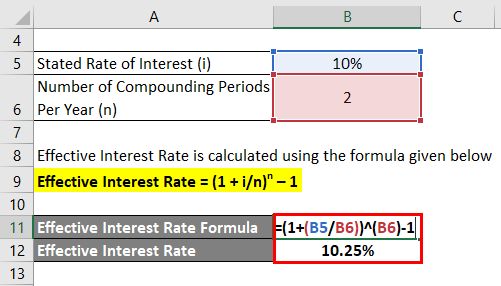

How To Calculate Effective Interest Rate 8 Steps With Pictures

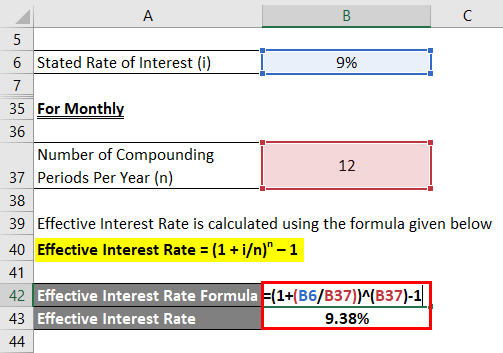

Effective Interest Rate Formula Calculator With Excel Template

Mortgage Amortization Table How To Create A Mortgage Amortization Table Download This Mortgage Amo Amortization Schedule Amortization Table Payment Schedule

Real Interest Rate Formula Calculator Examples With Excel Template

Excel Formula Calculate Interest Rate For Loan Exceljet

Calculating Potential Profit And Loss On Options Charles Schwab Implied Volatility Profit Option Trading

Using Rate Function In Excel To Calculate Interest Rate

Pin On How To Calculate Total Shareholder Returns Tsr

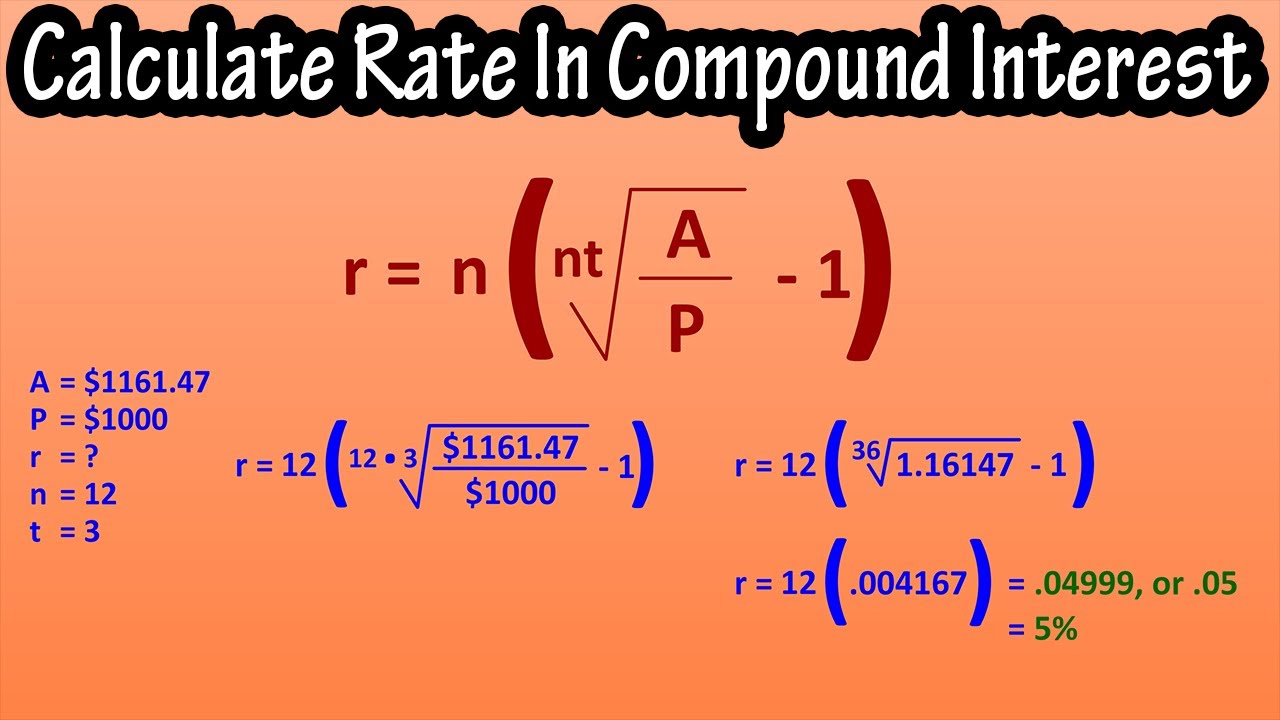

How To Solve For Or Calculate Rate In Compound Interest Formula For Rate In Compound Interest Youtube

Effective Interest Rate Formula Calculator With Excel Template

Pin By Robert Shoss On Stocks Financial Statement Cash Flow Financial

Implicit Interest Rate Meaning Calculation And Use Examples